Posted by Apex Home Loans ● March 24, 2022

Will Homes Continue to Rise in Price this Year?

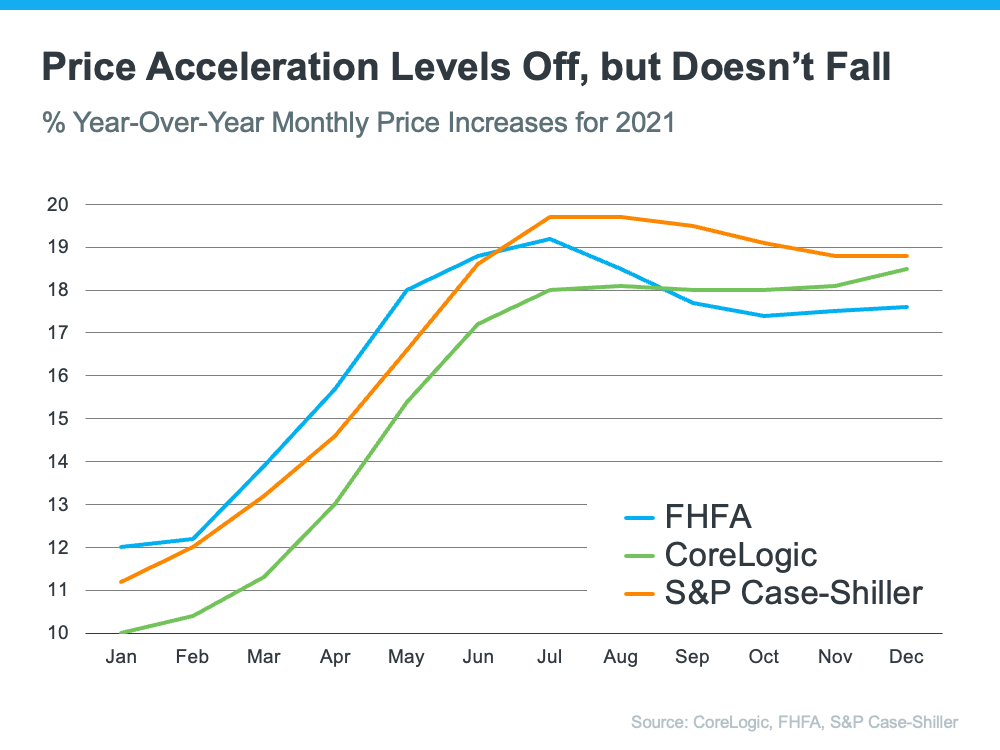

Last year, analysts predicted that home price appreciation would slow dramatically in the fall of 2021 and continue to soften at the start of 2022, but this hasn’t happened. Prices are still on the rise, and the appreciation is in the double digits. Here are a few reports on year-over-year price appreciation for December 2021:

- Federal Housing Finance Agency (FHFA): 17.6%

- S&P Case-Shiller: 18.8%

- CoreLogic: 18.5%

Below you will find a graph that shows the progression of all three indices for each month of 2021.

Home price appreciation rose considerably from January to June of 2021 according to the graph above. From August and on, the price acceleration was at a slower pace, but never declined. Many believed this was the first sign of a rapid slowdown, but as the chart shows, that wasn’t the case.

It’s important to understand that deceleration is not the same as depreciation. Acceleration means prices rise at a greater year-over-year pace than the previous month. Deceleration is when home values continue to rise but at a slower pace of year-over-year appreciation. On the other hand, depreciation is when prices drop below current values. None of the experts are expecting that to happen.

The FHFA disclosed that price appreciation accelerated in December in six of the nine regions it tracks. Additionally, Case Shiller showed that appreciation accelerated in 15 of the 20 metro areas that they report on. Selma Hepp, Deputy Chief Economist at CoreLogic shares:

“After some signs of slowing home price growth…monthly price growth re-accelerated again, indicating home buyers have not yet thrown in the towel.”

What Does This Mean to You as a Homebuyer?

You could be a first-time homebuyer or an experienced buyer, if you wait to buy a house, it could cost you in the long run. Here’s how:

- Mortgage rates are on the rise and this trend will continue.

- Home prices are expected to appreciate at double-digit levels for a while.

Bottom Line

No one is sure what the market will be like next month, but over the last year, home prices have accelerated. If you are considering buying a home soon, it is a good idea to start your hunt now. Experts agree that waiting to buy is risky as the price of homes will likely continue to rise, as well as mortgage rates. These two factors combined will make your monthly mortgage payment higher. Before you start your house hunt, connect with our team today. Our team of experts will look at your unique financial picture and goals to match you with the perfect mortgage.

Topics: Mortgages, Home Price Index, Home Prices, First Time Homebuyer, Homebuyer Tips, Mortgage Rates, Housing Market, Buying a Home, Market Outlook, Homebuyer, homebuying process, Buying Home During COVID-19, Mortgage for Millennials