Posted by Apex Home Loans ● May 18, 2022

Tips for Conquering a Bidding War

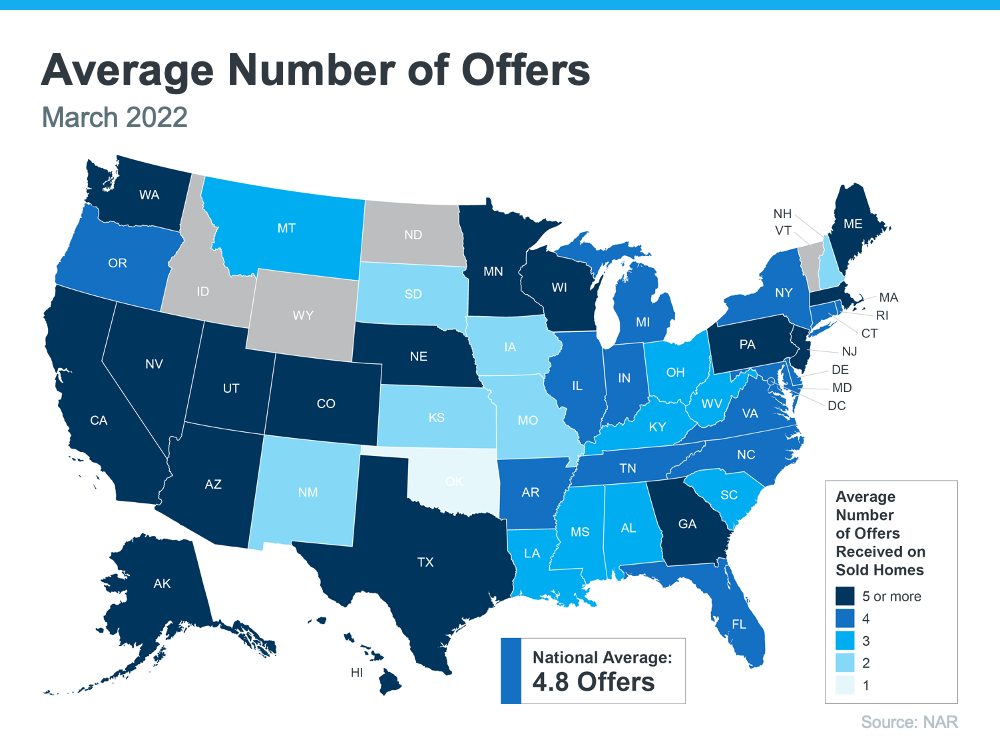

It’s no secret that there are more homebuyers in today’s market than there are homes for sale. Many of these homebuyers are eager to purchase their new home before mortgage rates rise further. Due to this combination, bidding wars are becoming increasingly more common. In fact, a recent report from the National Association of Realtors (NAR), nationwide, homes are receiving an average of 4.8 offers per sale. Below is a breakdown of what that looks like state-by-state.

This same NAR report shares that the average homebuyer makes two offers before their final offer is accepted. It’s important to know what levers to pull to conquer this market and purchase a home. While your trusted real estate team will be your ultimate guide to presenting a strong offer, we’ve pulled together a few options you may want to consider when making an offer on your dream home.

Start by Getting Pre-Approved

Before you even start perusing Zillow or Redfin, it’s important to talk to a lender and get pre-approved. During this process, your mortgage banker will take your application, pull your credit, and review your income and assets. Doing this at the very beginning of your homebuying journey is the best way to avoid home-heartbreak and gain a clear understanding of how much home you can actually afford. This process will also uncover any issues you might have before you start your house hunt.

When you start your homebuying journey by getting pre-approved, you will be able to hand your pre-approval letter to the seller, which proves you can afford their home. This sets you apart from other offers the seller may have and shows that you are a serious buyer.

Offer Over Asking Price

This was likely your first thought, but we have more to share on how to do this wisely. If you’re in the market to buy a home, you probably already know that most homes are currently selling for more than the asking price. This is because there are more buyers than there are homes for sale.

It is key that you make sure your offer is still within your budget and is realistic for the market value in your area. This is one reason why it’s important to have a real estate team you can trust on your side. Your mortgage banker will be able to help you come up with a budget that you’re comfortable with, and help you find your max buying price. Remember, that just because you can borrow a certain amount of money, doesn’t mean you should. Before you start your homebuying journey, take a good look at your finances and budget. Keep in mind that there are often unexpected costs to owning a home and it’s important to keep funds set aside for emergency. Talk to your Mortgage Banker for more insight on what you can afford. Your realtor will be able to provide more insight on what other homes in the area are selling for and give you guidance on the best price to offer.

Increase Your Earnest Money Deposit

An earnest money deposit is a check you write to go along with your offer. If your offer is accepted, this deposit is credited toward your home purchase. While the amount varies by location, an earnest money deposit is typically 1-2% of the home’s purchase price. Increasing this amount may catch the seller’s attention in a hot housing market. This shows sellers that you’re seriously interested in their house and have set aside money to put toward the purchase. Talk to your mortgage banker to see if this is something you can do in your area before submitting your offer.

Non-Financial Options

A recent article from Realtor.com sheds light on a few non-financial options to make your offer stronger.

“...Price is not the only factor sellers weigh when they look at offers. The buyer’s terms and contingencies are also taken into account, as well as pre-approval letters, appraisal requirements, and the closing time the buyer is asking for.”

While increasing the aforementioned financial portions of the deal can help, they’re not your only options. From a non-financial perspective, this includes things like flexible move-in dates or minimal contingencies (conditions you set that the seller must agree to for the purchase to be finalize). For example, you could consider making an offer that’s not contingent on the sale of your current home.

Talk to your real estate team for expert advice on where you can be flexible here. Your realtor will have the best insight on what sellers in your local market are looking for, and can help you navigate your proposal.

The Bottom Line

In any housing market, it’s important to have a local and trusted real estate team on your side to help you navigate today’s market and create the strongest offer possible for your unique situation. Our team of local experts are here to help! We’ll start by reviewing your unique financial picture and goals and match you with the perfect mortgage. Our team of experienced mortgage bankers can also help you navigate your homebuying budget, and even refer a trusted real estate agent. Contact us today to get started on your homebuying journey!

Topics: Mortgages, Home Prices, First Time Homebuyer, Housing Market, Market Outlook, Making an Offer, Pre-Approvals, benefits of owning a home, Making Strong Offer in Sellers Market, Competitive Offer Tips, market value, earnest money deposit