Posted by Apex Home Loans ● June 1, 2022

Experts Chime in on 2022 Home Prices and What’s to Come

Whether you are a potential homebuyer, seller, or both, you may be wondering if home prices will begin to fall this year. Keep reading to find out what’s happening with home prices, what the experts are saying, and ultimately, how both of these things impact your homeownership goals.

The Current State of Home Prices

According to CoreLogic, price appreciation averaged 15% for the full year of 2021, up from the 2020 full year average of 6%. This is due to the fact that we have been in a seller’s market. Meaning there are more buyers in the market than there are homes for sale. We can expect the upward pressure on home prices due to the imbalance in today’s housing market.

What are the Experts Saying about Home Prices?

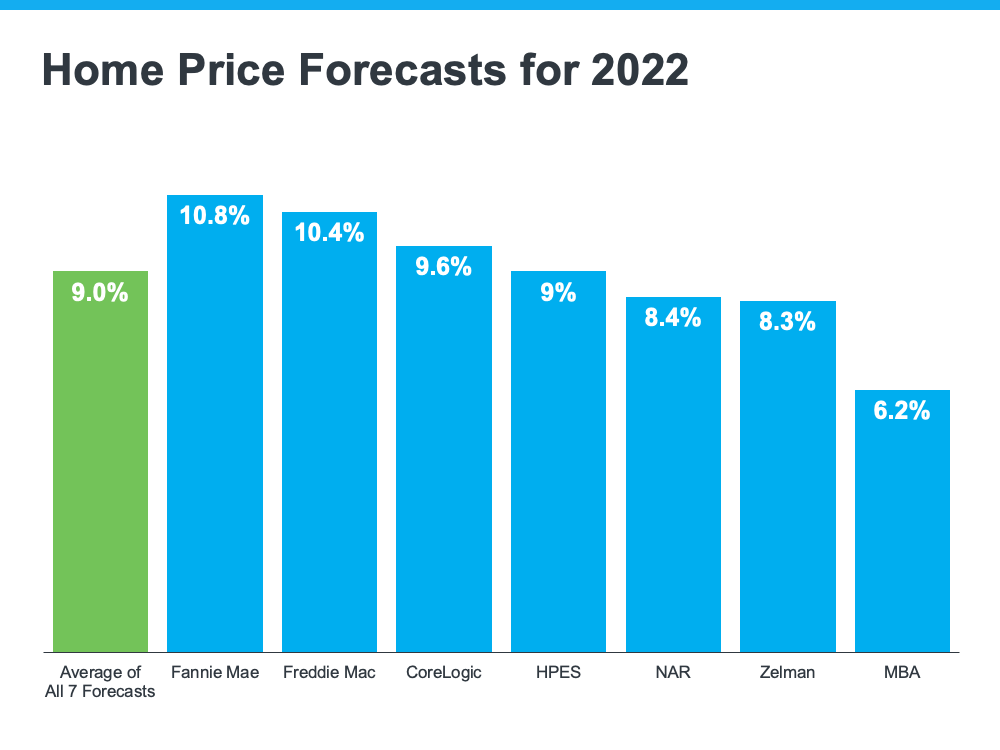

Great question. Because of the aforementioned imbalance between supply and demand, experts do not believe the housing market is set up for a price decline. Recent home price forecasts for 2022 reveal ongoing appreciation throughout 2022.

As you can see in the graph above, experts agree on a more moderate price appreciation and price gains will remain strong throughout the year. First American elaborates a little more on this…

“While house price growth is expected to moderate from the rapid pace of 2021, strong home buyer demand against a backdrop of historically tight inventory of homes for sale will likely keep appreciation positive in the coming year.”

What Does This Mean for You?

Whether you’re in the market to buy a home, sell your home, or both, your biggest takeaway is that none of the experts are projecting depreciation. And, in either case, waiting to make your next move could cost you in the long run. The rise in mortgage rates combined with the rising home prices will have an impact on your home purchase. Here’s what Freddie Mac says:

“If you’re thinking about waiting until next year and that maybe rates are higher, but you’ll get a deal on prices – well that’s risky. It may be more advantageous to purchase this year relative to waiting until 2023 at this time.”

The Bottom Line

Don’t let this news discourage you from taking the next steps in your homebuying (and possibly selling) journey. If you’re on the fence, and want to weigh out your options or want to learn more about your financing options, contact us… soon. Experts agree that the home prices will continue to rise, and waiting could hurt you in the long run. Let our team of experts take a look at your unique financial picture and goals to match you with the perfect mortgage for your dream home.

Topics: Freddie Mac, Mortgages, Home Price Index, Home Prices, First Time Homebuyer, Homebuyer Tips, Mortgage Rates, Housing Market, Market Outlook, Home Mortgage Rates, Homebuyer, home pricing, Competitive Offer Tips, rising mortgage rates, market value, house price growth, depreciation