Posted by Apex Home Loans ● March 30, 2020

Madness in the Market: Updated Report March 30

Monday, March 30, 2020

What's going on and why does it matter?

Mortgage bonds opened higher this morning after rallying sharply in last week's trading session. Since the Fed restarted its buying program on March 16, it has purchased a whopping $250.94 billion of mortgage bonds, with another $200 billion scheduled to be purchased this week. To put this in perspective, by the end of this week, the Fed will have purchased in two weeks the equivalent of 20% of all the mortgage volume originated throughout all of 2019. Although mortgage rates have generally improved, various loan types such as jumbo loans and loans that don't conform to Fannie Mae and Freddie Mac guidelines have actually seen massive disruptions. This is due to the lack of liquidity in the bond market for those types of loans.

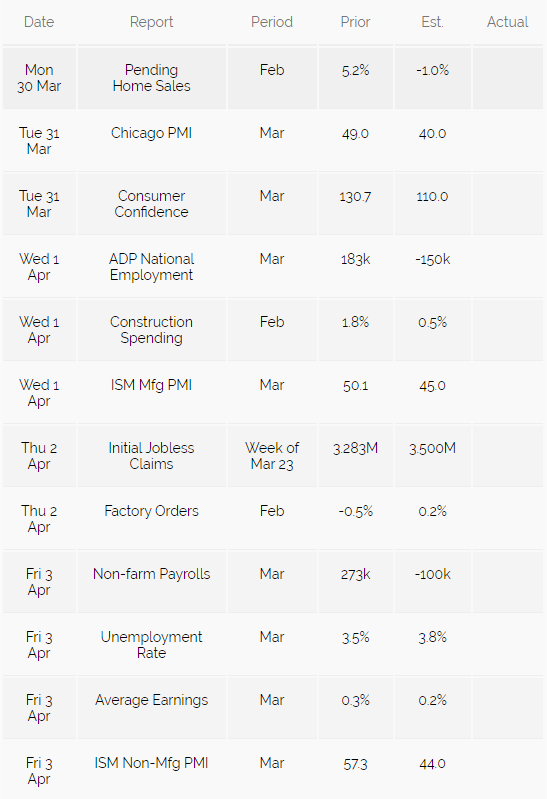

Economic reports that may impact mortgage rates this week:

The economic calendar this week will see a number of higher tiered releases for March which will likely show the beginnings of the coronavirus impact on the economy. These releases include Chicago PMI and consumer confidence on Tuesday; ADP employment and ISM manufacturing PMI on Wednesday; initial jobless claims on Thursday, and ISM non-manufacturing and the March Employment report on Friday.

Please be aware: by refinancing your existing mortgage, your total finance charges may be higher over the life of the loan.

Topics: Refinance, Interest Rates, Mortgage Interest Rates, home loan refinance, lower interest rate, Corona Virus, COVID-19