Posted by Apex Home Loans ● August 24, 2020

Madness in the Market: Updated Report August 24, 2020

Monday, August 24, 2020

What's going on and why does it matter?

Mortgage bonds opened lower this morning as a new week gets underway. Stocks are in rally mode on hopes of a Covid-19 treatment instigated by the news that President Trump is considering fast-tracking a vaccine and on the FDA’s emergency authorization to allow convalescent plasma as a treatment. Outside of that, there was little other news over the weekend or overnight beyond the usual. Coronavirus cases are continuing to rise and there has been no progress between Republicans and Democrats on a stimulus package. The economic calendar is full this week, and the Republic National Convention kicks off this evening. The Fed is scheduled to purchase up to $4.979 billion of mortgage bonds today. Since the restart of the Fed's massive bond-buying program on March 16, the Fed has purchased a staggering $964.1 billion of mortgage bonds.

What should you do about it?

Watch for mortgage bond pricing to improve.

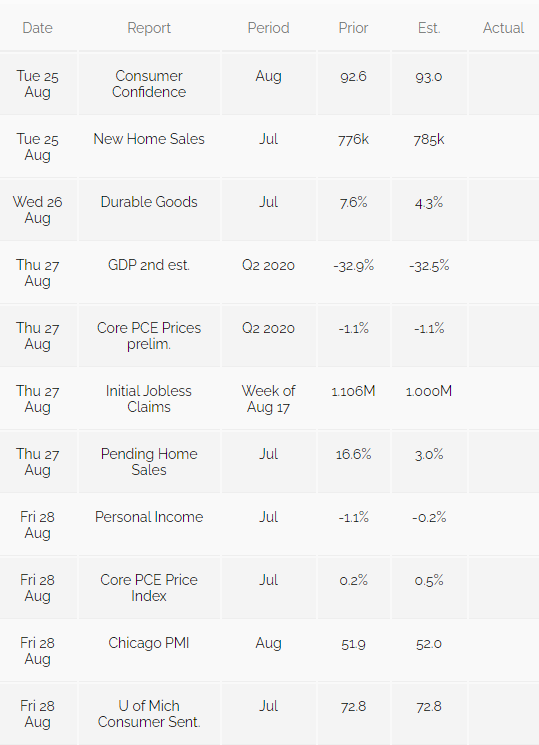

Economic reports that may impact mortgage rates this week:

Please be aware: by refinancing your existing mortgage, your total finance charges may be higher over the life of the loan.

Topics: Refinance, Interest Rates, Mortgage Interest Rates, home loan refinance, lower interest rate, Corona Virus, COVID-19