Posted by Apex Home Loans ● August 31, 2020

Madness in the Market: Updated Report August 31, 2020

Monday, August 31, 2020

What's going on and why does it matter?

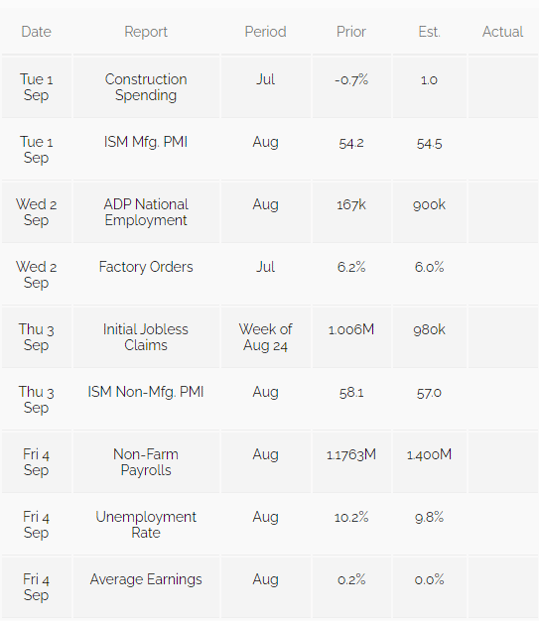

Mortgage bonds opened flat this morning and they are drifting sideways as global stock prices mostly lean higher. The market is still processing the potential implications of the Fed’s announcement last week that it will shift its policy to tolerate higher inflation. The economic calendar is quiet today. It picks up tomorrow, and there are several high-tiered economic reports scheduled for release later this week, including Friday's always-important jobs report. The Fed is scheduled to purchase up to $4.975 billion of mortgage bonds today, while daily supply has averaged around $6.1 billion per day.

What should you do about it?

Watch and see if mortgage bonds can rebound from these levels, but be prepared to lock your rate quickly if mortgage bond prices resume their decline.

Economic reports that may impact mortgage rates this week:

Please be aware: by refinancing your existing mortgage, your total finance charges may be higher over the life of the loan.

Topics: Refinance, Interest Rates, Mortgage Interest Rates, home loan refinance, lower interest rate, Corona Virus, COVID-19