Posted by Apex Home Loans ● March 27, 2020

Madness in the Market: Updated Report March 27

Friday, March 27, 2020

What's going on and why does it matter?

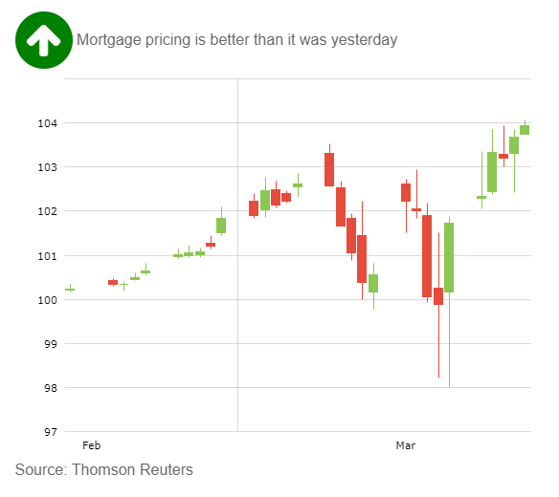

Mortgage bonds are trading higher again this morning as the House gets ready to vote on the massive $2 trillion economic stimulus package later today. The stock market is set to open lower this morning as the number of coronavirus cases in the US has grown to over 82,000, making our country the new epicenter of the virus. In the UK, both Prince Charles and Prime Minister Boris Johnson have contracted the virus. The Fed is scheduled to purchase up to $50 billion of mortgage bonds today, which should help keep interest rates stable for the most part. Since the Fed restarted its bond-buying program on March 16, it has purchased nearly $210 billion of mortgage bonds. To put this in perspective, that's equivalent to 10% of all the mortgage volume originated throughout all of 2019.

What should you do about it?

Watch for mortgage bonds to remain in positive territory, but be prepared to lock your rate quickly if the market changes directions.

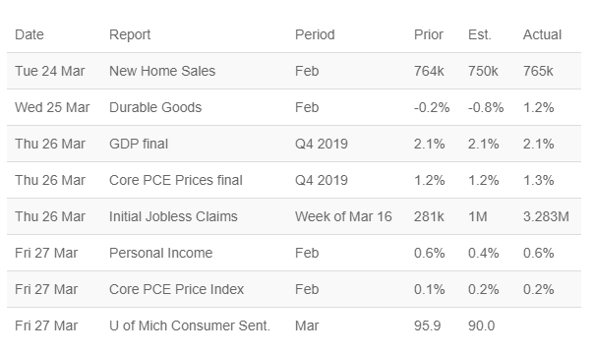

Economic Calendar

Economic reports that may impact mortgage rates this week:

Please be aware: by refinancing your existing mortgage, your total finance charges may be higher over the life of the loan.

Topics: Refinance, Interest Rates, Mortgage Interest Rates, home loan refinance, lower interest rate, Corona Virus, COVID-19