Posted by Apex Home Loans ● July 27, 2020

Madness in the Market: Updated Report July 27, 2020

Monday, July 27, 2020

What's going on and why does it matter?

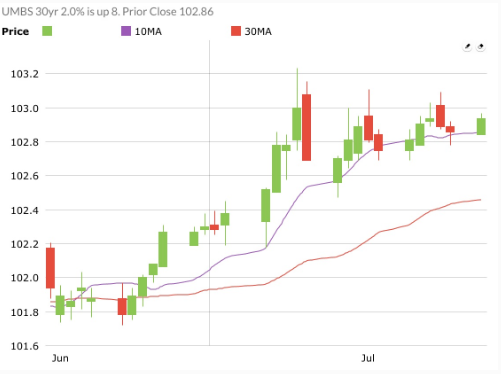

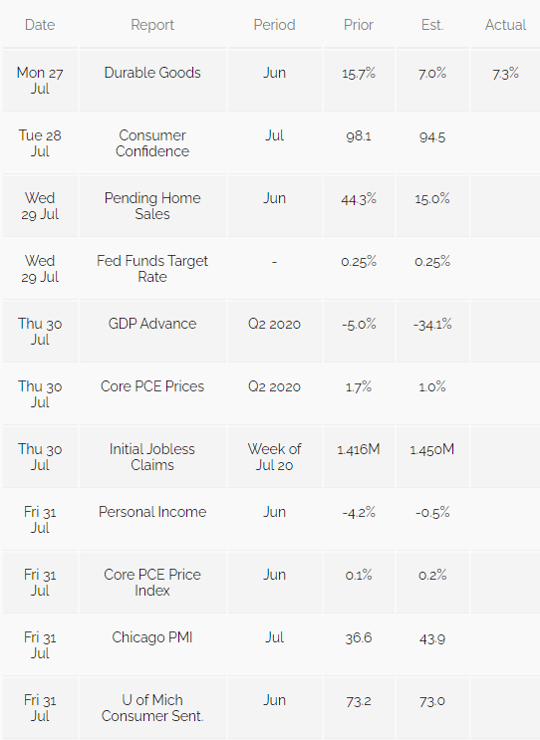

Mortgage bonds are trading in positive territory above their 10-day moving average as the last week of July gets underway. This is a big week for the market with the Fed's interest rate decision and monetary policy statement scheduled for release on Wednesday, followed by the first peek at Q2 GDP on Thursday, which is expected to show a whopping 34% decline in the economy. Meanwhile, tensions between the US and China continue to escalate and the ongoing spike in Covid-19 cases around the world is leading to fresh lockdowns and other restrictive measures. Over the weekend, Senate Republicans and the White House appear to have reached an agreement on another $1 trillion stimulus/aid package that still needs to be reconciled with the House Democrats’ bill. The Fed is scheduled to purchase up to $5.573 billion of mortgage bonds today, while supply has been running around $6.7 billion per day.

What should you do about it?

Watch for mortgage bonds to remain in positive territory, but be prepared to lock your rate if mortgage bonds fall below their 10-day moving average.

Economic reports that may impact mortgage rates this week:

Please be aware: by refinancing your existing mortgage, your total finance charges may be higher over the life of the loan.

Topics: Refinance, Interest Rates, Mortgage Interest Rates, home loan refinance, lower interest rate, Corona Virus, COVID-19