Posted by Apex Home Loans ● August 17, 2020

Madness in the Market: Updated Report August 17, 2020

Monday, August 17, 2020

What's going on and why does it matter?

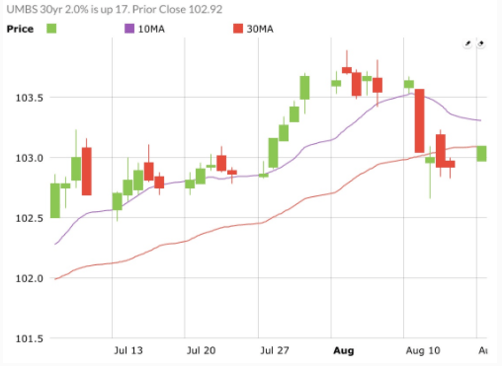

Mortgage bonds opened slightly higher this morning as financial markets enter into their typical late summer doldrums period. The mortgage industry at large is still grappling with Fannie Mae and Freddie Mac's announcement last week that all refinance transactions closing after September 1 will cost 0.5% more in points. This is especially causing problems for borrowers who were counting on the lower rates when they initially agreed to refinance. On today's economic calendar, the NY Fed (Empire State) Manufacturing Index came out weaker than market expectations. In other news, the Democratic National Conventional gets underway later today and runs through Thursday followed by the Republican National Convention from Monday through Thursday of next week. Both Conventions are taking place virtually. The Fed is scheduled to purchase up to $4.978 billion of mortgage bonds today, compared to a daily average supply of $7 billion.

What should you do about it?

Lock your rate to be safe.

Economic reports that may impact mortgage rates this week:

Please be aware: by refinancing your existing mortgage, your total finance charges may be higher over the life of the loan.

Topics: Refinance, Interest Rates, Mortgage Interest Rates, home loan refinance, lower interest rate, Corona Virus, COVID-19