Posted by Apex Home Loans ● August 10, 2020

Madness in the Market: Updated Report August 10, 2020

Monday, August 10, 2020

What's going on and why does it matter?

Mortgage bonds opened flat this morning as a new week gets underway with mortgage rates at an all-time record low. Investors, like everyone else, are trying to manage their way through the pandemic as updated news on the coronavirus is mixed with glimmers of hope. Although economic reports in the US were positive last week, there are concerns that the data has yet to capture the June/July wave of virus spread. In the meantime, US-China tensions continue to simmer and the drama in Washington continues to unfold with Congress unable to come to an agreement on a new economic stimulus package and President Trump taking unilateral action by issuing executive orders. The Fed is scheduled to purchase up to $3.548 billion of mortgage bonds today.

What should you do about it?

Watch for mortgage bonds to rebound off their 10-day moving average.

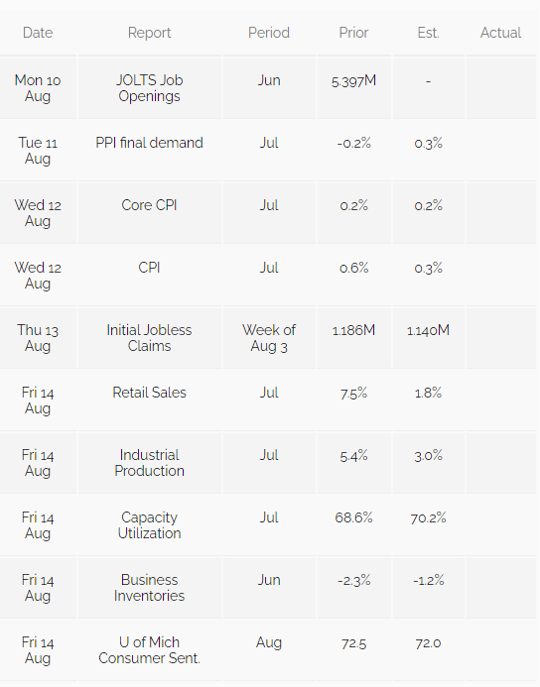

Economic reports that may impact mortgage rates this week:

Please be aware: by refinancing your existing mortgage, your total finance charges may be higher over the life of the loan.

Topics: Refinance, Interest Rates, Mortgage Interest Rates, home loan refinance, lower interest rate, Corona Virus, COVID-19