Posted by Apex Home Loans ● April 8, 2020

Madness in the Market: Updated Report April 8, 2020

Wednesday, April 8, 2020

What's going on and why does it matter?

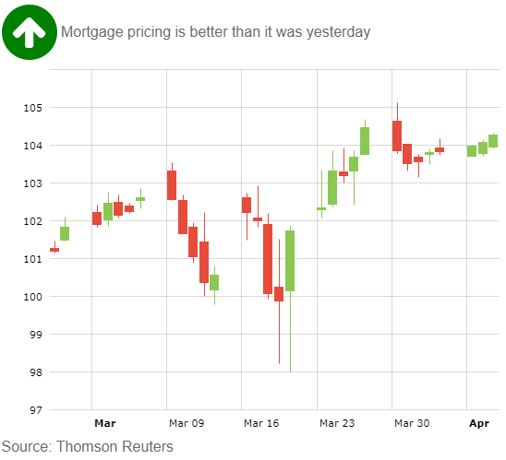

Mortgage bonds are continuing to drift sideways, riding their 10-day moving average. Today is the last full trading day of the week, with the bond market scheduled for an early close tomorrow and a full close Friday. Stocks are set to open higher this morning in what is likely to be another volatile day for the financial markets. It's still unclear how long the economic lockdown will remain in force, although positive signs are starting to emerge across the world. Wuhan, China where the coronavirus originated, is no longer on lockdown, while countries such as Denmark, Norway, and Austria are looking to begin relaxing some of their lockdown restrictions in the coming days.

What should you do about it?

Watch and see if mortgage bonds can hold their ground, but be prepared to lock your rate quickly if bond prices break below their 10-day moving average.

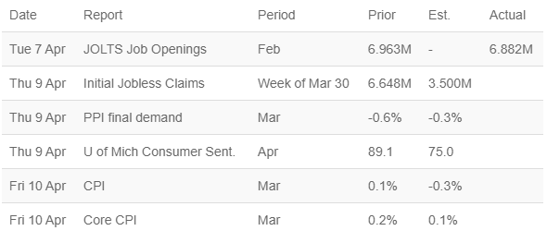

Economic reports that may impact mortgage rates this week:

Please be aware: by refinancing your existing mortgage, your total finance charges may be higher over the life of the loan.

Topics: Refinance, Interest Rates, Mortgage Interest Rates, home loan refinance, lower interest rate, Corona Virus, COVID-19