Posted by Apex Home Loans ● April 17, 2020

Madness in the Market: Updated Report April 17, 2020

Friday, April 17, 2020

What's going on and why does it matter?

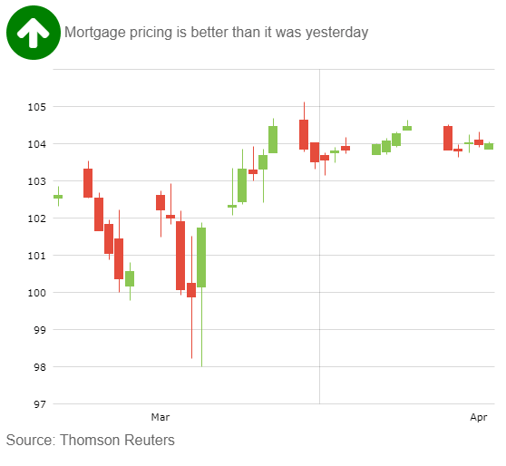

Mortgage bonds opened slightly lower this morning and stock prices are set to open sharply higher as financial markets are encouraged by news that a drug developed by Gilead Sciences was showing promise in treating Covid-19. President Trump also announced new guidelines to re-open the economy in a staggered, three-stage process, although the decision was left up to the state governors. As for mortgage bonds, they seem to be hugging their 10-day moving average, and it will be interesting to see if they can remain above that level. The Fed is scheduled to purchase up to $14.55 billion of mortgage bonds today as it continues to support the market.

What should you do about it?

Watch and see if mortgage bonds can remain above their 10-day moving average, but be prepared to lock your rate quickly if bond prices break convincingly below their 10-day moving average.

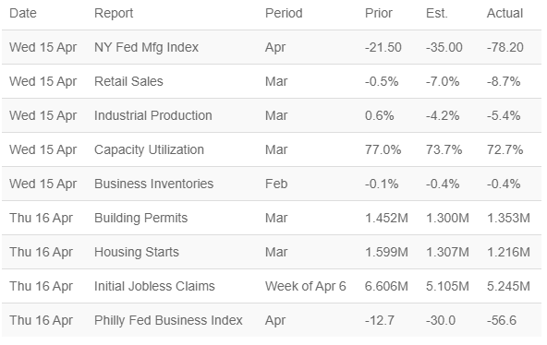

Economic reports that may impact mortgage rates this week:

Please be aware: by refinancing your existing mortgage, your total finance charges may be higher over the life of the loan.

Topics: Refinance, Interest Rates, Mortgage Interest Rates, home loan refinance, lower interest rate, Corona Virus, COVID-19