Posted by Apex Home Loans ● April 15, 2020

Madness in the Market: Updated Report April 15,2020

Wednesday, April 15, 2020

What's going on and why does it matter?

Mortgage bonds opened slightly higher this morning and they are trading near their 10-day moving average as the "flight-to-quality" trade takes hold in the financial markets once again. Global stock prices were down between 1% and 2% overnight after the IMF released a forecast yesterday warning of a 3% decline in global economic activity with the global economy expected to experience its worst financial crisis since the Great Depression. This is quite a change from the beginning of the year when the organization was projecting a 3.3% global expansion. Corporate earnings have also taken a huge hit, with more pain expected in the months to come. The NY Fed (Empire State) Manufacturing Index plunged to a record low this morning, highlighting the sharp decline in economic activity caused by the coronavirus. The Fed is scheduled to purchase up to $14.6 billion of mortgage bonds today as its massive bond-buying program continues.

What should you do about it?

Watch and see if mortgage bonds rally above their 10-day moving average, but be prepared to lock your rate quickly if bond prices break convincingly below their 10-day moving average.

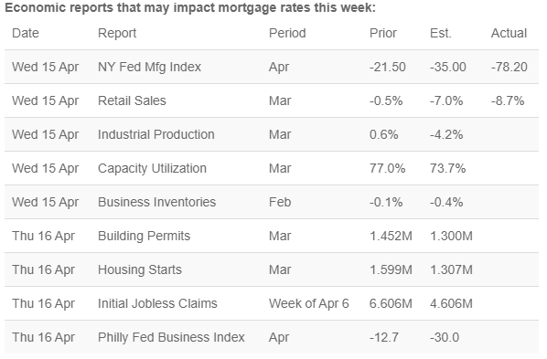

Economic reports that may impact mortgage rates this week:

Please be aware: by refinancing your existing mortgage, your total finance charges may be higher over the life of the loan.

Topics: Refinance, Interest Rates, Mortgage Interest Rates, home loan refinance, lower interest rate, Corona Virus, COVID-19