Posted by Apex Home Loans ● April 13, 2020

Madness in the Market: Updated Report April 13, 2020

Monday, April 13, 2020

What's going on and why does it matter?

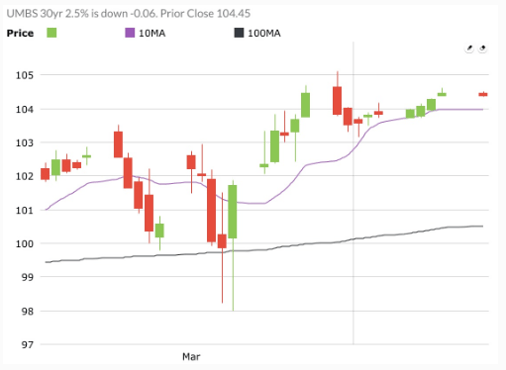

Mortgage bonds are continuing to drift sideways, riding their 10-day moving average. Market sentiment remains focused on the coronavirus and its economic impact with over 550,000 cases in the US. The market will get a glimpse of the economic impact with some of the reports on this week's economic calendar, as well as some of the Q1 corporate earnings reports scheduled to be released this week. Also influencing markets is the agreement reached on Sunday between the major global oil produces to cut production and stabilize the price of oil.

The Fed is scheduled to purchase up to $75 billion of mortgage bonds this week, compared to the nearly $100 billion of mortgage bonds purchased last week. Since the restart of the Fed's massive bond-buying program on March 16, the Fed has purchased a whopping $446.1 billion of mortgage bonds, making it the biggest if not the only buyer of mortgage bonds in the market. This has had the impact of stabilizing mortgage rates for the most part. However, the market is still unstable or non-existent for most jumbo loans and other loans that don't conform to Fannie Mae or Freddie Mac guidelines.

What should you do about it?

Watch and see if mortgage bonds can remain in positive territory, but be prepared to lock your rate quickly if bond prices break below their 10-day moving average.

Economic reports that may impact mortgage rates this week:

Please be aware: by refinancing your existing mortgage, your total finance charges may be higher over the life of the loan.

Topics: Refinance, Interest Rates, Mortgage Interest Rates, home loan refinance, lower interest rate, Corona Virus, COVID-19