Posted by Apex Home Loans ● April 1, 2020

Madness in the Market: Updated Report April 1, 2020

Wednesday, April 1, 2020

What's going on and why does it matter?

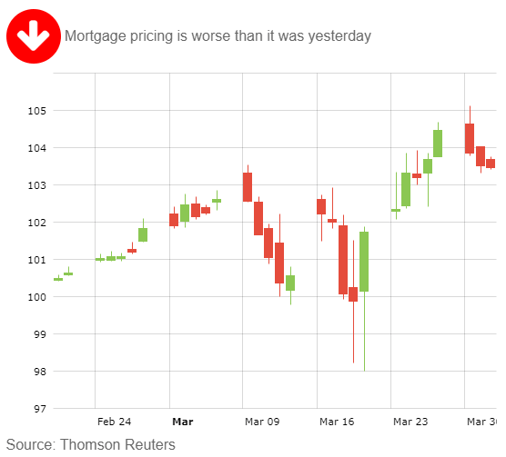

Mortgage bonds are trading slightly higher this morning amidst dire coronavirus-related headlines. Global stock prices are sharply lower after warnings by President Trump late yesterday that deaths in the US could reach between 100,000 and 240,000 and that the next two weeks would be “very, very painful”. Meanwhile, the ADP employment report came out this morning showing the first decline in private payrolls since 2017. The Fed is scheduled to purchase up to $30 billion of mortgage bonds today, which may help to ease the volatility in mortgage bond prices.

What should you do about it?

Watch and see if mortgage bonds can rally, but be prepared to lock your rate quickly if bond prices start to decline.

Economic reports that may impact mortgage rates this week:

Please be aware: by refinancing your existing mortgage, your total finance charges may be higher over the life of the loan.

Topics: Refinance, Interest Rates, Mortgage Interest Rates, home loan refinance, lower interest rate, Corona Virus, COVID-19