Posted by Apex Home Loans ● January 23, 2018

What Is a Mortgage Credit Certificate and How Do They Work?

A Mortgage Credit Certificate (MCC) is a certificate for primary residences that entitles you as a homeowner to an additional tax benefit when you file your federal income tax returns. They are offered through a state housing agency and must be purchased at the time of closing. Generally, you must meet the same requirements as buyers using the state housing agency’s loan programs (although you aren’t required to use a housing agency loan program to get a MCC). Those requirements vary from state to state, but usually include limitations on your household income, maximum mortgage amount, and a requirement that you cannot have owned a home in the last three years. There are usually some additional closing costs to purchase the MCC up front as well.

So, what is the benefit of an MCC?

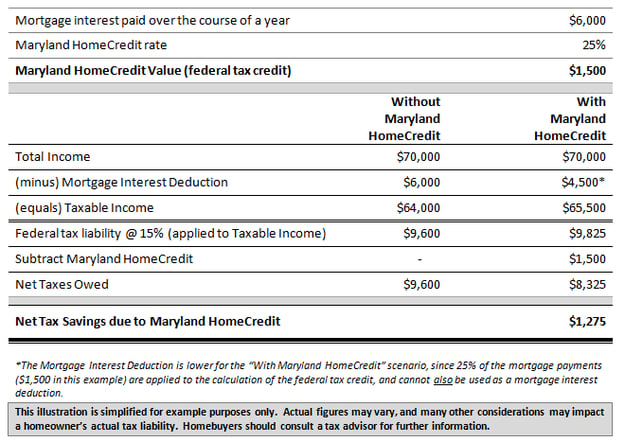

Most people are aware that you can deduct mortgage interest on your federal tax returns. What the MCC does is shift some of the deduction to a direct credit. In Maryland, the MCC entitles you to take 25 percent of your mortgage interest (up to $2000) as a credit instead of a deduction. Other states have slightly different rules on the percentages and caps, but most are around the 20 or 25 percent range.

As an example of how the MCC benefits the homeowner, let’s take a look at a scenario from the Maryland Department of Housing and Community Development. Since a MCC is 25% of that year's mortgage interest payments, with $6,000 of mortgage interest paid throughout the year and a 15% tax bracket, this homeowner could deduct $1,275 per year thanks to the HomeCredit.

The biggest benefit of the MCC, however, is that you get to continue taking that credit every year for the life of your original mortgage! In the example above, the homeowners could save $12,750 over the first ten years of the loan.

Looking to Get Started with a MCC?

The Mortgage Credit Certificate offers a great financial benefit for new homeowners -- and it's not widely known. If you would like more information or to find out if you qualify, give us a call!

Topics: Buying a Home, down payment assistance, Homeownership, mortgage credit certificate, first time buyer programs