Posted by Apex Home Loans ● April 15, 2021

Surge in Cash-Out Refinances Should We Be Concerned

Freddie Mac released their Quarterly Refinance Statistic Report not too long ago which covers refinances through 2020. This report shows that the dollar amount of cash-out refinances was greater in 2020 than in recent years. You might be wondering, “What is a cash-out refinance?” Investopia defines it as:

"A mortgage refinancing option in which an old mortgage is replaced for a new one with a larger amount than owed on the previously existing loan, helping borrowers use their home mortgage to get some cash."

The same Freddie Mac report led to articles like the one published by The Real Deal, House or ATM? Cash-Out Refinances Spiked in 2020, which reports:

"Americans treated their homes like ATMs last year, withdrawing $152.7 billion amid a cash-out refinancing spree not seen since before the 2008 financial crisis."

1. Americans are holding onto their home equity today.

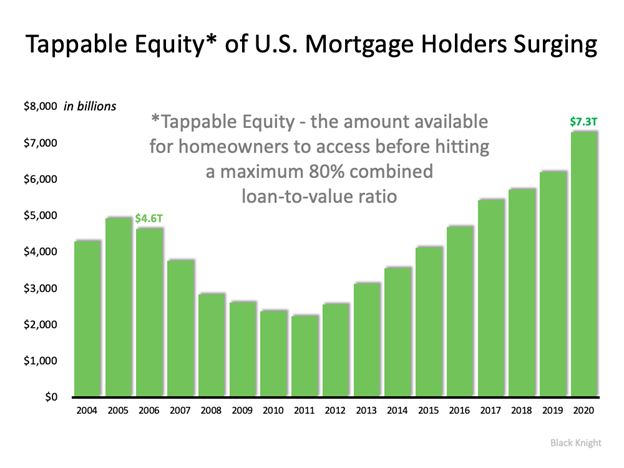

Mortgage data giant Black Knight recently issued information regarding the amount of tappable equity homeowners with a mortgage have. What is tappable equity? It is the amount of equity available for homeowners to use and still have 20% equity in their home. Below is a graph that shows the findings from their report:

As Black Knight explains:

"At year's end, some 46 million homeowners held a total of $7.3 trillion in tappable equity, the largest amount ever recorded… That's an increase of more than $1.1 trillion (+18%) since the end of 2019, the largest percentage gain since 2013 and – you guessed it – the largest dollar value gain in history, to boot. All in all, it works out to roughly $158,000 on average per homeowner with tappable equity, up nearly $19,000 from the end of 2019."

2. Homeowners didn’t cash out as much as they did in 2006.

U.S citizens cashed out a total of $321 billion in 2006. Last year, U.S. citizens cashed out less than half at $153 billion. The $321 billion in 2006 made up 7% of the total tappable equity in the country. During 2020, the $153 billion made up only 2% of the total tappable equity.

3. Less homeowners used their equity last year than in 2006.

Freddie Mac says that 89% of refinances in 2006 were indeed cash-out refinances. Last year, it was less than half being 33%. As a percentage of those who refinanced, people lowered their equity fifteen years ago when compared to last year.

Many U.S. citizens liquidated a part of their equity in their home(s) last year for several different reasons. With that being said, less than half of them tapped into their equity compared to 2006, they also cashed-out less than one-third of their available equity. Today’s cash-out refinance situation sees no resemblance to the 2008 market crash.

Bottom Line for Refinancers

Cash-out refinances are on the rise and for some, this might mean rolling in an existing home equity line of credit, paying off some credit card debt, or getting money for a home improvement. Now is a great time to refinance before rates go back up like they were before the pandemic. Connect with our team today to see if a cash-out refinance is right for your financial goals!

Topics: Home Equity, Refinancing Your Home, Cash Out Refinancing, mortgage refinance