Posted by Apex Home Loans ● February 23, 2022

Are You a First-Generation Homebuyer? We Have Some Advice!

When you become a homeowner, you have a sense of pride that is hard to find elsewhere. The feeling is even greater if you are looking to become a first-generation homebuyer.

Becoming a homeowner has several different impacts on your life. If you are looking to purchase a home and are the first one in your family to do so, let that be a driver. Below we have listed some tips to help you get started on your homebuying journey.

1. Know What You Can Afford

The best piece of advice we can give you is to start your homebuying journey by doing your research on how much you can afford. We recommend that you get your finances in order, review your budget, and most importantly get pre-approved. During the pre-approval process, your lender will take your application, pull credit, and review your income and assets. This allows them to give you an idea of what you can afford up front and before you start looking for houses. A pre-approval letter also helps strengthen your offer as it shows that you have already been pre-approved for financing.

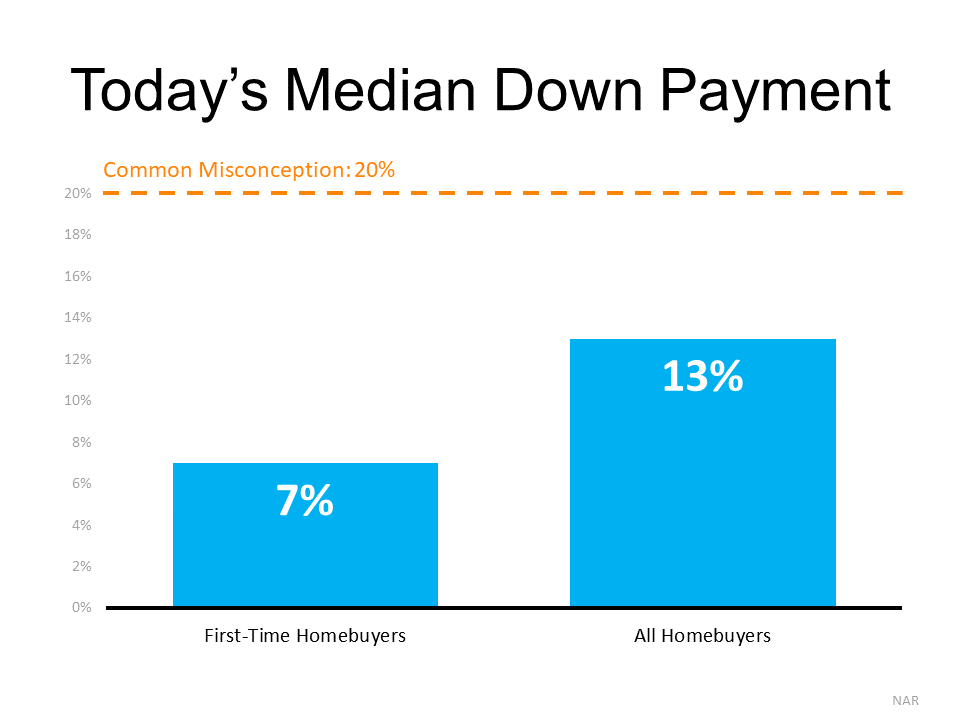

You also want to make sure you have enough money set aside for your down payment and closing costs. If you think you need a 20% down payment in order to buy a home, think again.

“The most damaging down payment myth—since it stops the homebuying process before it can start—is the belief that 20% is necessary," says Freddie Mac.

Below you will find a graph of the median down payment homeowners paid.

Many people think a 20% down payment is necessary, but in reality it isn’t. As you can see, on average, first-time homebuyers put down 7%. This may mean you can afford more house than you originally thought. This is another reason why talking to your lender first is key. Your lender will look at your current financial status and goals and help you determine how much you’ll need for your down payment, closing costs, and how much you can afford to borrow.

2. Find a Real Estate Professional That Suits You

Once you get pre-approved from a lender you can start your search to find a real estate professional. They will help you find a home that fits your needs. This could be anything to location to the number of bedrooms you need.

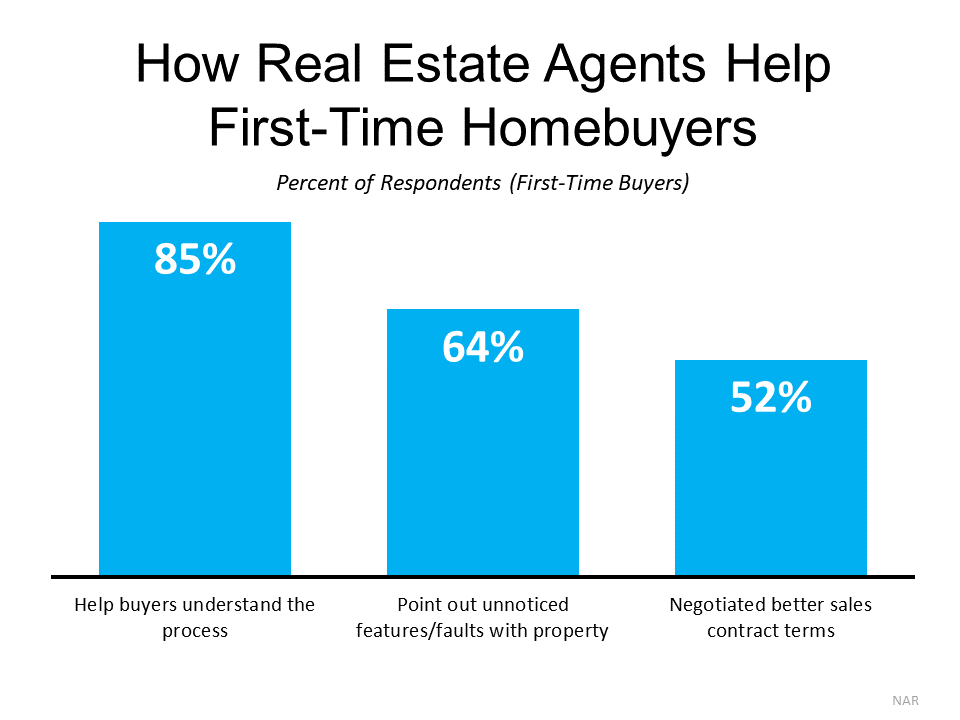

The National Association of Realtors recently surveyed first-time homebuyers asking how their real estate agent helped with their home search. According to this survey 85% of first-time homebuyers said that their agent helped give them a better understanding of the process.

Your real estate agent is likely to give you more help than just finding a dream home. They will answer any questions you may have about the process, point out any issues they see in the homes you’re eyeing, and make a contract that is hopefully a winning offer. These are just a few of the many reasons to have a trusted real estate agent on your “team”.

3. Don’t Lose Sight of What Home Means to You

An important question to ask yourself is, “Why am I looking for a home?”. First-generation homeowners look at the financial and non-financial pros of being a homeowner.

In a survey from Fannie Mae homeowners said the following about owning a home compared to renting:

- 88% - a better chance of saving for retirement

- 87% - the best investment plan

- 85% - the chance to be better off financially

- 85% - the chance to build up wealth

Bottom Line

As a first-generation homebuyer, it’s important to have a trusted team on your side. A real estate professional will help you find your dream home that is within your budget and covers all of your needs. An experienced mortgage professional can help you determine what you qualify for and the product options available that best fit your situation and provide a pre-approval letter to get you started on your search for a home. Whether your motivation for buying is a large backyard for Fido, or simply a strong desire to have a place of your own, we can help! Connect with our experienced team of mortgage professionals today to get started on your homebuying journey!

Topics: Real Estate Agents, Home Equity, Mortgages, rent vs. buy, Down Payments, Down Payment, First Time Homebuyer, Homebuyer Tips, Housing Market, Buying a Home, Market Outlook, homebuying tips, benefits of homeownership, Homebuyer, low down payment mortgage, Buying Home During COVID-19, Mortgage for Millennials, Pandemic Home Buying, First Generation Homebuyer