Posted by Apex Home Loans ● February 9, 2022

If You Are Currently Renting, Consider These Four Things

Every year when your lease is coming to an end, you probably ask yourself, “Should I keep renting or find a home to purchase?” This answer will change depending on if you want to stay in the area or move around. Below we have listed four factors you should consider before you decide to keep renting.

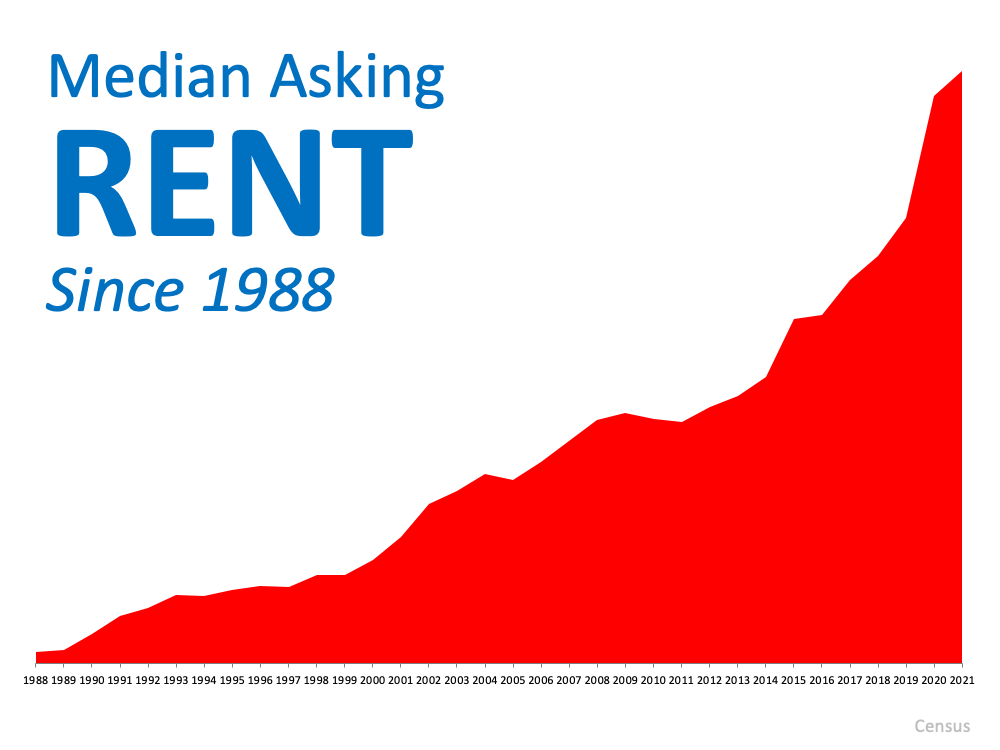

1. Rent Is on the Rise

If you decide to extend your lease, you may notice that your monthly rent changed and is not in your favor. Rent has been on the rise for the last few decades. See the graph below from the Census that illustrates the increase since 1988.

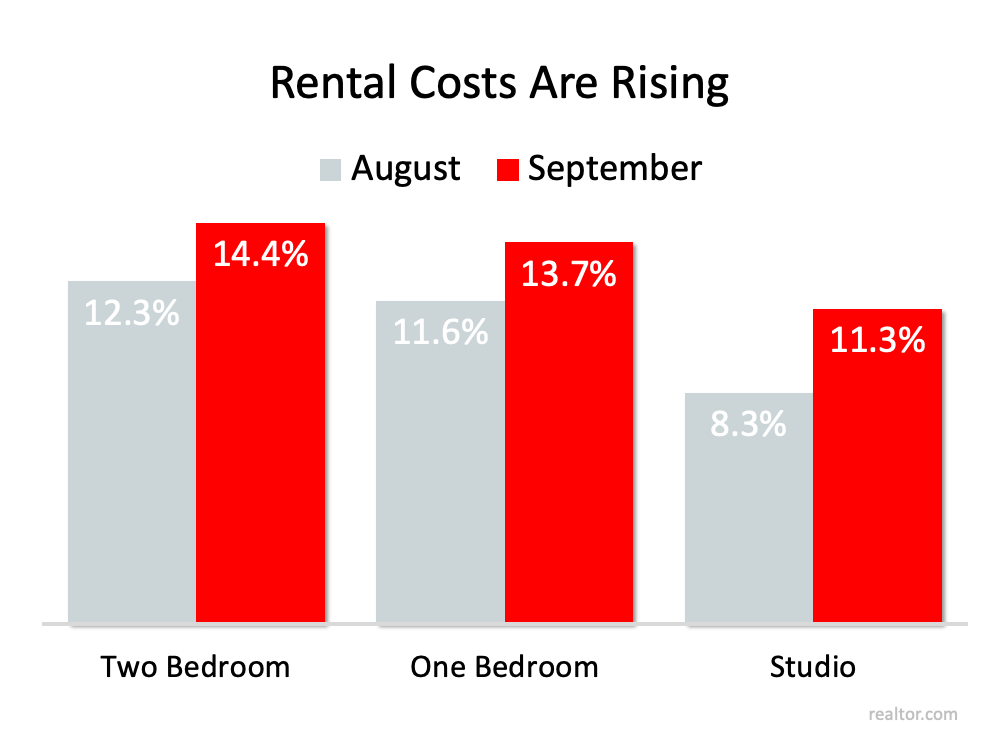

Surprisingly, the cost of rent is steadily increasing on a monthly basis as well. Below you will find a graph from Realtor.com of their September Rental Report, which shows the rent rising from August 2020 to September 2020.

2. As a Homeowner, You Are Free to Customize Your Home

When you start looking at homes, you might find a house that you fall in love with, but you hate how the kitchen looks. If you end up purchasing the home, you can change the kitchen to just how you want it. When you are renting, you don’t have this freedom. Generally, renters have little freedom when it comes to customizing their dwelling place.

3. Renting Means Missing Out on Equity Gains

Being a homeowner has many perks. Not only can you personalize your home, but you also gain equity over time. When you grow equity, you also grow your net worth. This can be used to fund your retirement, help you buy a larger home, or even help you start up your own business. When you are renting, you are unable to grow home equity.

4. Owning a Home Provides Great Mobility

While renting a home, it feels like you can move at any time. We are happy to tell you that this can be done when you own your home as well! According to the National Association of Realtors, homes are staying on the market for an average of 17 days in our current market. If you think there’s a chance you’ll want to move across the country in the coming years, don’t worry. Owning your home shouldn’t keep you from achieving this!

Bottom Line

Deciding if it’s the right time to buy a home can be a difficult decision to make. You may find that the pros outweigh the cons for being a homeowner. When you become a homeowner, your monthly payments will stay the same if you have a fixed rate mortgage, you can customize your home, and so much more! If you’re considering taking the leap to buy a home of your own soon and want to see what you may be able to afford, connect with our team! Click the link below to start the conversation and let our team of financing experts analyze your unique financial picture and goals to match you with the perfect mortgage.

Topics: Home Equity, Mortgages, rent vs. buy, First Time Homebuyer, Homebuyer Tips, Housing Market, Buying a Home, Market Outlook, homebuying tips, benefits of homeownership, Homebuyer, Buying Home During COVID-19, Mortgage for Millennials, Pandemic Home Buying, Rent Costs, Rental Market