Posted by Apex Home Loans ● May 18, 2020

Madness in the Market: Updated Report May 18, 2020

Monday, May 18, 2020

What's going on and why does it matter?

Mortgage bonds opened flat this morning while global stock prices are in rally mode as a new week of trading gets underway. Financial markets were encouraged by comments made by Federal Reserve Chairman Powell in an interview on CBS’ “60 Minutes” last night where he said the Fed was not out of ammunition and that “there’s really no limit to what we can do with these lending programs that we have." The Fed Chairman said that he expects unemployment to get worse in the near term, but he expressed confidence in a strong economic recovery in the second half of the year. Global stock prices rallied overnight on this news and US stocks are set to open higher as well.

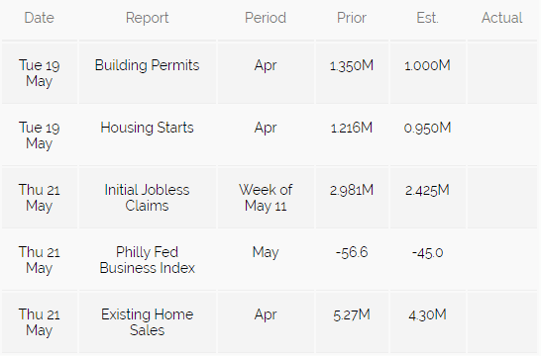

The economic calendar is relatively light this week, although there are a few high-tier economic reports scheduled for release including building permits and housing starts tomorrow and the minutes from the Fed's April meeting on Wednesday. The market closes early on Friday for a long Memorial Day weekend. The Fed is scheduled to purchase approx. $4.5 billion of mortgage bonds each day this week, which is down from up to $5 billion per day last week.

What should you do about it?

Lock your rate to be safe.

Economic reports that may impact mortgage rates this week:

Please be aware: by refinancing your existing mortgage, your total finance charges may be higher over the life of the loan.

Topics: Refinance, Interest Rates, Mortgage Interest Rates, home loan refinance, lower interest rate, Corona Virus, COVID-19