Posted by Apex Home Loans ● June 29, 2020

Madness in the Market: Updated Report June 29, 2020

Monday, June 29, 2020

What's going on and why does it matter?

Mortgage bonds are trading at the upper end of their recent trading range as this holiday-shortened week gets underway. Headlines related to the coronavirus remain grim as global deaths top 500,000 and many places see a record number of daily increases in new cases, leading to a slowdown in reopenings. The economic calendar is quite full this week and it includes the always-important jobs report which is scheduled to be released on Thursday. The market closes early on Thursday and is fully closed on Friday for a long Independence Day weekend. The Fed is scheduled to purchase up to $4.665 billion of mortgage bonds today.

What should you do about it?

Watch and see if mortgage bonds can remain above their 10-day moving average, but be prepared to lock your rate if mortgage bonds fall below that level.

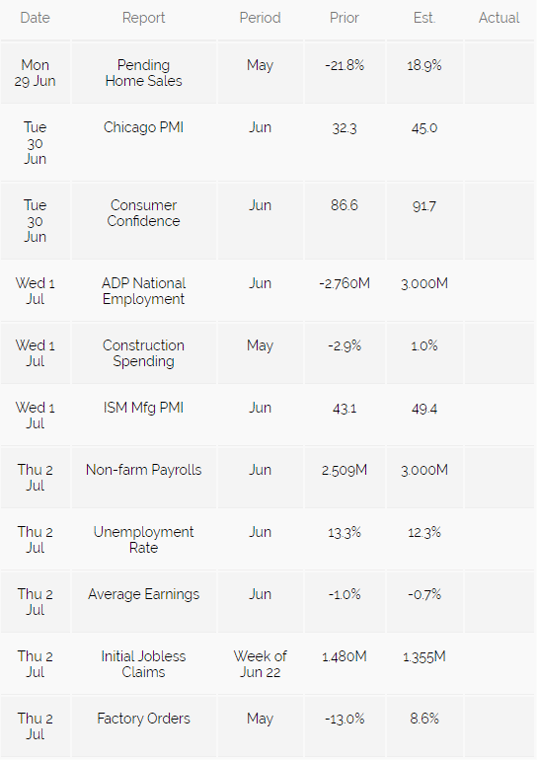

Economic reports that may impact mortgage rates this week:

Please be aware: by refinancing your existing mortgage, your total finance charges may be higher over the life of the loan.

Topics: Refinance, Interest Rates, Mortgage Interest Rates, home loan refinance, lower interest rate, Corona Virus, COVID-19