Posted by Apex Home Loans ● July 20, 2020

Madness in the Market: Updated Report July 20, 2020

Monday, July 20, 2020

What's going on and why does it matter?

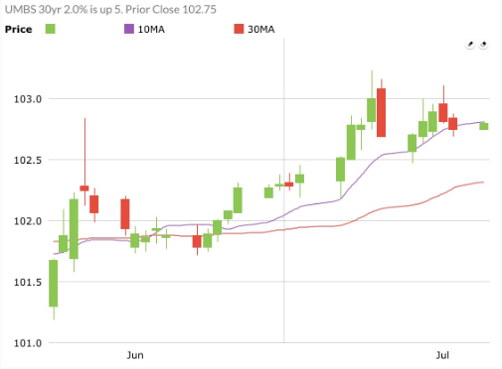

Mortgage bonds opened near their 10-day moving average as market sentiment continues to bounce back and forth between hopeful expectations of a Covid vaccine and worries about the spike in cases. The World Health Organization reported a global daily record on Saturday of nearly 260,000 with the US making up 27% of that at 70,000, and Florida representing nearly 20% of the spike in the US numbers. This rise has lead to fresh lockdowns and backtracking on re-openings in some locations. On the bright side, pharmaceutical company Synairgen said that a clinical trial of a new respiratory treatment had reduced the number of hospitalized patients needing intensive care.

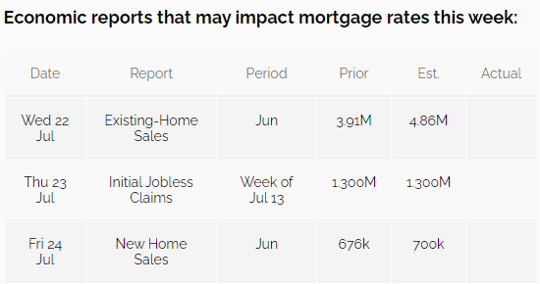

As for economic news, the European Union was unable to reach an agreement over the weekend on a post-pandemic recovery fund, although some progress has been made towards a compromise. Meanwhile, the US Congress is set to start debate this week on a new economic aid package. The economic calendar is relatively quiet this week, although the Fed is scheduled to purchase an average of $4.8 billion of mortgage bonds each day this week, which is over 60% of the average daily supply which has been running at around $7.8 billion.

What should you do about it?

Watch and see if mortgage bonds can remain above their 10-day moving average, but be prepared to lock your rate if mortgage bonds fall convincingly below that level.

Economic reports that may impact mortgage rates this week:

Please be aware: by refinancing your existing mortgage, your total finance charges may be higher over the life of the loan.

Topics: Refinance, Interest Rates, Mortgage Interest Rates, home loan refinance, lower interest rate, Corona Virus, COVID-19