Posted by Apex Home Loans ● April 22, 2020

Madness in the Market: Updated Report April 22, 2020

Wednesday, April 22, 2020

What's going on and why does it matter?

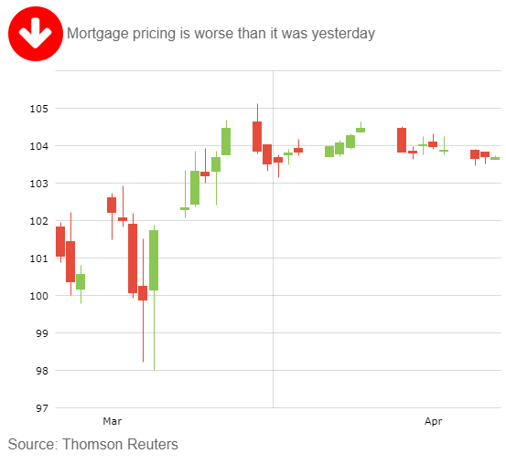

Mortgage bonds are continuing to drift sideways between their 10-day and 30-day moving averages. Stocks were pointed to a higher open this morning after the recent sharp sell-off related to plunging oil prices and the glut of oil supply. The market seems to be encouraged by the passage by the Senate late yesterday of a $484 billion coronavirus relief package to help small businesses and hospitals, with more funding for testing. The Fed is continuing to support the mortgage market with a scheduled purchase of up to $10.7 billion of mortgage bonds today, which represents roughly 35% of the new supply being issued.

What should you do about it?

Lock your rate to be safe.

Economic reports that may impact mortgage rates this week:

Please be aware: by refinancing your existing mortgage, your total finance charges may be higher over the life of the loan.

Topics: Refinance, Interest Rates, Mortgage Interest Rates, home loan refinance, lower interest rate, Corona Virus, COVID-19