Posted by Apex Home Loans ● April 20, 2020

Madness in the Market: Updated Report April 20, 2020

Monday, April 20, 2020

What's going on and why does it matter?

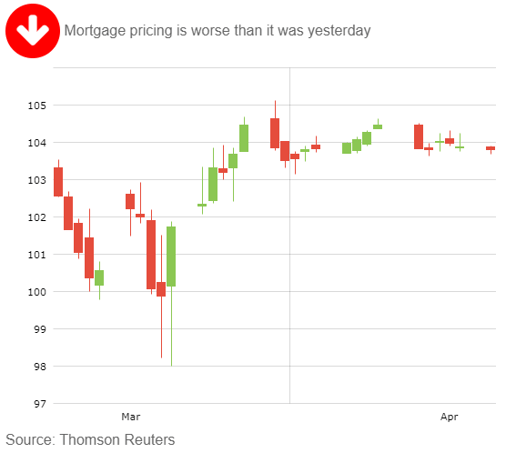

Mortgage bonds opened lower this morning as a new week gets underway. The world economy is continuing to revolve around coronavirus headlines and the indefinite nature of the crisis. Oil prices plunged another 28% amidst excess supply and very low demand from the shelter-in-place directives and business shutdown. Meanwhile, financial markets are digesting headlines that Japan increased its economic stimulus package by a record $1.1 trillion while the US is expected to roll out the second round of loans to small businesses totaling around $370 billion. As for the mortgage market, the Fed is scheduled to purchase up to $10 billion of mortgage bonds each day this week as it continues to support the market. Since the restart of the Fed's massive bond-buying program last month, the Fed has purchased over a half-a-trillion dollar's worth of mortgage bonds.

What should you do about it?

Lock your rate to be safe.

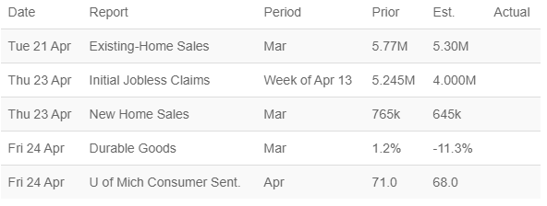

Economic reports that may impact mortgage rates this week:

Please be aware: by refinancing your existing mortgage, your total finance charges may be higher over the life of the loan.

Topics: Refinance, Interest Rates, Mortgage Interest Rates, home loan refinance, lower interest rate, Corona Virus, COVID-19