Posted by Apex Home Loans ● November 3, 2021

Are We Heading into Another Housing Crash like 2008?

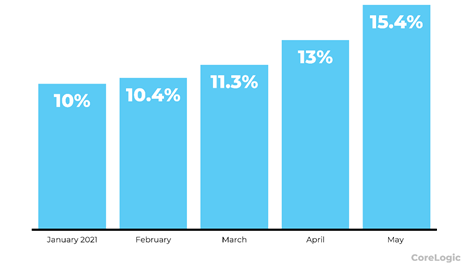

The U.S. housing market has been in overdrive much before the pandemic. Housing prices climbed between 2012 and 2019. This period was the third largest housing boom in American history. Below we have shared a graph that shares just how much prices are rising in the housing market.

Month-Over- Month Price Appreciation - 2021

Since the housing prices have surpassed the peak of the 2008 housing crash, many people are worried we are heading into another market crash. Don’t worry -this isn’t predicted.

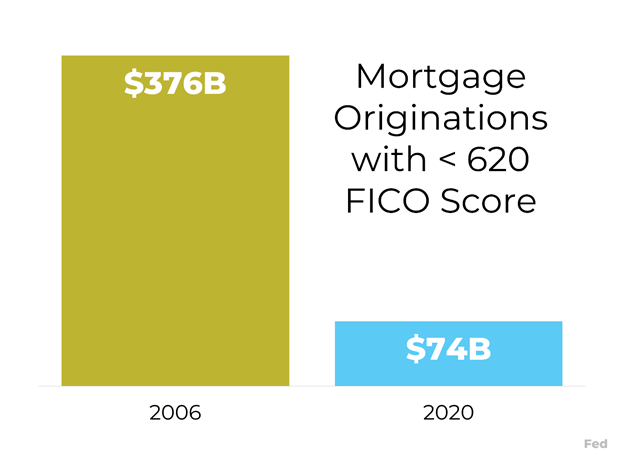

Today’s lending standards are a lot more solid than they were in the 2008 housing crash! It is very important to understand the difference in the quality of loans now versus the quality of loans in the 2008 market crash, as Dr. Frank Nothaft from CoreLogic explains:

“There are marked differences in today’s run up in prices compared to 2005, which was bubble fueled by risky loans and lenient underwriting. Today, loans with high-risk features are absent and mortgage underwriting is prudent.”

Back in 2006, the volume of mortgage loans given to those with a credit score of 620 or below was $376 billion compared to $74 billion in 2020. This shows that lending standards are stricter now.

During the 2008 housing bubble, when home prices went up, people were refinancing their home as well as pulling out large amounts of money. They were using their home like it was an ATM. This caused the market to spiral into a negative equity situation. On the flipside, homeowners today are letting their equity build.

No one can say for sure what the real estate market will do in the future, but the experts are sure we will have a market dip, but not a crash, like we did in 2008. Even though houses prices are on the rise, the D.C. area is indicated to be overpriced by less than 1%, on the other hand Baltimore is underpriced. Additionally, the pricing in the D.C. metro area is very stable given the crazy market we are in. If you were waiting for home prices to come down, now is the time to buy in these areas, because that might not happen. If you would like to get your homebuying journey started, connect with our experienced team today!

Topics: FICO Scores, Real Estate, Home Equity, Housing Prices, Mortgages, Home Prices, Mortgage Loans, First Time Homebuyer, Housing Market, Market Outlook, Credit Scores, homebuying process, Mortgages for Millennials, Pandemic Home Buying