Posted by Apex Home Loans ● November 5, 2020

Becoming a Homeowner Early Can Dramatically Increase Your Future Wealth

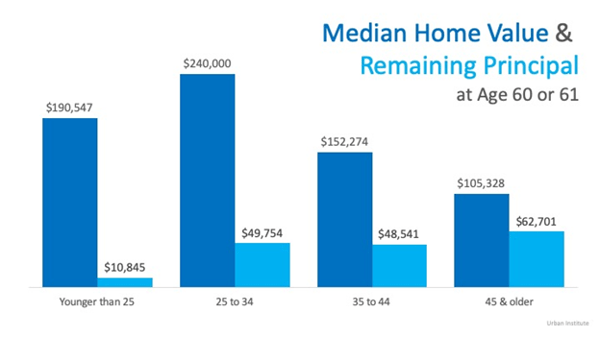

The Urban Institute’s study shows that homeowners who purchase a house before the age of 35 are better prepared for retirement by the time they reach 60.

The good news is homeownership is important to our younger generations.

According to a Freddie Mac survey,

“The dream of homeownership is alive and well within “Generation Z,” the demographic cohort following Millennials.

Our survey…finds that Gen Z views homeownership as an important goal. They estimate that they will attain this goal by the time they turn 30 years old, three years younger than the current median homebuying age (33).”

Urban Institute study shows the impact that aspiring homeowners can have if they purchase at an early age.

Based on this data, those who purchased their first homes when they were younger than 25 had an average of $10,000 left on their mortgage at age 60. The 50% of buyers who purchased in their mid-20s and early-30s had close to $50,000 left, but traditionally purchased more expensive homes.

Although most Gen Zer’s want to own a home and are somewhat confident in their future, “in terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Bottom Line

As the numbers show, you’re not alone. If you want to buy this year but you’re not sure where to start, connect with us today and we will help you move forward in the process.

Topics: Financial Planning, local lender Montgomery County, MD, millennial homebuyers